Term Insurance

Term insurance is a type of life insurance, which offers financial coverage to your nominee in case of your death, within the period term. It makes sure that your family is well-taken care of after your demise. With the help of riders (add-ons), you can cover disease and disability under term insurance as well. It's one of the best ways to protect the financial future of your family cheaply.

What is a Term Life Insurance Policy?

A term life insurance policy is a contract between the insurer and the policyholder that ensures the financial needs of the policyholder's family are taken care of in the event of his death. However, the coverage of the term insurance is limited to the life of the insured within the term of the policy.

Why Is It Important To Invest In Term Insurance?

With the frequency of accidents and diseases increasing per day, your plan of living a long life may seem far fetched. That means, if you die, your family should have a financial backup to take care of their needs. That's why investment experts in the industry suggest investing in a term insurance plan and that too at a young age. Term insurance will help your family to live a stable life even after your demise. It will provide much needed financial support to meet their daily expenses and fulfill their long-term goals (such as your child's education, marriage, etc.) as well.

Let's understand the importance of Term Insurance through this example:

Varun and Manik were very close family friends working in the same company as IT professionals. Somehow, Varun decided to invest in Term Insurance with a life cover of Rs.1 Crore (with monthly payout benefit option) and even suggested Manik do the same. Manik didn't like the idea and thought it was a waste of money, as there are no maturity benefits, and invested in a traditional life cover policy.

After 3 years, they were traveling to Jaipur by road and met with an accident. Both of them died on the spot. Though both the families were in grief, Varun's family was a bit relieved as they had the financial support of the term insurance. With Varun's term insurance plan, his family got the monthly payment for the next 10 years. Manik's family, on the other hand, only had a traditional life cover of Rs. 5 Lakhs and had to figure out a way to meet their expenses.

The motive of this example- though human life is priceless and the grief of losing someone close can't be described in words, having a financial backup with a term insurance policy can at least offer support to meet all financial expenses.

Best Term Insurance Plans In India

Sr. No. | Company Name | Term Insurance Plans | Entry Age (years) | Minimum Sum Assured (Rs.) | Claim Settlement Ratio 2018-19* |

1. | HDFC Life | 18,25-65 | 50 Lakhs | 99.04% | |

2. | Max Life | 18-60 | 10 lakhs | 98.74% | |

3. | ICICI Prudential | 18-65 | Subject to minimum premium | 98.58% | |

4. | LIC | 18-65 | 50 Lakhs | 97.79% | |

5. | Kotak Mahindra | E-term | 18-65 | 25 Lakhs | 97.40% |

6. | Aditya Birla | Life Shield | 18-65 | 25 Lakhs | 97.15% |

7. | PNB Metlife | Mera Term Plan | 18-65 | 10 Lakhs | 96.21% |

8. | Edelweiss Tokio | Zindagi Plus | 18-65 | 25 Lakhs | 95.82% |

9. | SBI Life | 18-65 | 35 Lakhs | 95.03% | |

10. | Bajaj Allianz | Smart Protect Goal | 18-65 | 50 Lakhs | 95.01% |

*We have also prepared a list of the top 20 term insurance plans in India 2021 in detail.

What Are The Types Of Term Insurance Plans?

Level Term Plan

It is the simplest plan of the lot. Under this, there is no change in the sum assured and the nominee will reap the benefits once the insured is dead. For example, if someone buys a cover of Rs.1 crore, it will remain constant throughout the policy term. This type of plan is offered by almost every insurance company and is available in Pan India.TROP (Term Return of Premium)

TROP is a term plan that comes with an option of 'Return of Premium'. The best part of the TROP plan is that it assures maturity benefits. The policy turns out to be beneficial if the insured survives the term of the policy. This type of term plan is best-suited for those who want their paid premiums back at the end of policy terms.Increasing Term Insurance Plan

Under this type, the sum assured will increase annually by a certain percentage pre-specified by the insurer and the premium will remain the same. This plan is launched keeping in mind the growing rate of inflation. For example, Mr. Ankur buys an increasing term insurance plan for 20 years that offers a 5% rate of increase in the sum assured. With every year, the sum assured will increase by 5%.Decreasing Term Insurance Plan

It is a renewable term insurance plan. Under this, the sum assured is decreased every year by a pre-specified percentage. This plan is usually issued by banks to recover the loan and clear all the debts. For example, Mr. Ankur buys a decreasing term insurance plan for 20 years that offers a 5% rate of decrease in the sum assured. At the end of each year, the sum assured reduces by 5%.Convertible Term Insurance Plan

This type of plan can be converted into another type of life insurance plan (from standard to endowment or whole life), providing dual benefits.Group Term Insurance Plan

It offers coverage to a group of employees under a single policy. In case one employee resigns from the company, (s)he will lose all their insurance benefits.Online & Offline Term Insurance Plans

Online term insurance plans are the ones that can be bought through the internet, whereas for buying an offline term insurance plan, one needs to coordinate with the agent or directly visit the company's branch.Joint Life Term Insurance Plan

Here, you can cover yourself and your spouse under the same plan. In the unfortunate event of anyone's death, the surviving partner will receive the death benefit as per the plan's TnCs.

What Are The Key Features & Benefits Of Term Insurance?

Financial Protection

In case of your unfortunate demise, your family will receive the sum assured, which will help them to fulfill their financial requirements.Higher Sum Assured with Low Premium

Term insurance plans are available at a very nominal cost. It may be as low as some hundreds or thousands per month. As compared to that, the sum assured can be in lakhs and crores (depending on the customization of policy options).Lifetime Cover

Generally, term insurance plans offer coverage until 65 years. However, there are a few life insurance companies, which provide coverage for 100 years as well. So, if you buy a term plan at an early age, you and your family can enjoy its benefits for a long time.Multiple Death Benefit Payout Options

A term insurance plan lets you choose your death benefit payout as per your needs and requirements. One can choose from Lump-sum payment, Monthly Income, Lump-sum + Monthly Income, and Increasing Monthly Income.Additional Riders

To enhance the overall protection, you can add several riders to your term insurance plan. One can opt for optional riders benefits such as critical illness, accidental death/disability, etc. by paying additional premiums.Tax saving

Yes, this is an additional benefit of investing in a term insurance plan. On buying the same, you are liable to get tax benefits under section 80D and 10(10D) of the Income Tax Act, 1961.Free Lookup Period

At times, you may not be sure about the policy. It happens when you buy term insurance in a hurry. To resolve this issue, IRDAI has introduced a concept named 'Free-look Period', where all the insurance companies offer 15 days to change your decision. If you are unhappy with the policy, you can return the original policy documents (in that duration) to cancel the policy.Ease of Payments

When it comes to payment, you can always choose the premium payment mode according to your convenience. You can pay monthly, quarterly, half-yearly, or annually. Many people prefer to pay the premium monthly, as it comes at a very nominal price. Payments can be easily made online. You can do it either through debit/credit card, NEFT, net banking, IMPS, or wallet banking.Buying Flexibility

There are two channels from where you can buy term insurance plans- offline and online. You can physically visit the branch office of your selected provider to purchase the policy or you can approach the most convenient online channel- PolicyX.com.

At PolicyX.com, we provide a customized portfolio as per your needs and requirements. We have a dedicated team to assist you with all your queries. From documentation to filing claims, they are always on their toes to serve you in the best possible way.

Term Insurance: Payout Options

The term insurance offers 4 types of death benefit payout options to choose from. They are as follows:

Lump-sum Payment

Under this option, the claimant's family will receive the lump sum amount. For example, if the policyholder has chosen a sum assured of Rs. 1 crore, then the lump sum amount of Rs. 1 crore will be paid to the claimant.

Monthly Income

With this option, the beneficiary will receive the total sum assured in monthly installments. For example, if the sum assured is Rs. 1.2 crores, then the family of the policyholder will receive Rs.1 lakh/month for 10 years.

Lump-sum + Monthly Income

With this option, the beneficiary will receive 50%-70% of the assured amount (in a lump-sum) just after the death of the insured, and the rest of the amount is paid through monthly installments. Suppose the policyholder has chosen a sum assured of Rs. 1 crore and has opted for 50%-50% of lump-sum and monthly installments. On his death, the family of the policyholder will receive Rs.50 lakhs and the remaining amount will be paid in monthly installments.

Increasing Monthly Income

Under this option, the beneficiary will get the total sum assured in increasing monthly installments. The installments increase @10-20% (yearly) to help the dependents fight inflation. For example: If the policyholder's family gets Rs.1,00,000/month, and the increasing percentage is 10%, then from the next year, the family will receive Rs.1,10,000/month.

Which Riders Are Available Under Term Insurance?

Insurance companies allow you to avail of add-ons (riders) with your term insurance policy on paying an extra premium. A brief explanation of such riders is given below-

Critical illness Rider

Critical illness riders cover many illnesses that are deadly in nature. You can buy this rider if you are prone to any such illness. Before taking the rider, you can always check the additional cost and decide accordingly.

- Covers more than 30 deadly diseases.

- Entire hospitalization expenses are covered with the help of lump-sum payment.

Accidental Death Rider

If this rider is taken, then accidental death is covered. The insurance company will offer the sum assured along with the rider benefit to the nominee of the policyholder.

- Provides added financial protection.

- Some insurance policies provide this as an inbuilt feature.

Cashless Treatment Rider

With this rider, you will get complete cashless treatment at the time of any illness/surgery.

- Access to the chain of cashless hospitals.

- Great benefits with not much investment.

Premium Waiver Rider

As per this rider, all the future premiums are waived off if the policyholder is disabled, critically ill, or dead.

- No financial burden to pay the premium.

- No effect on the sum assured.

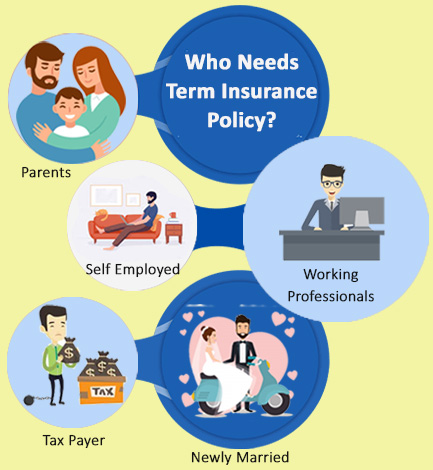

Who needs to buy a Term Insurance Policy?

Life is uncertain, and no one can predict what the future holds for us. Therefore, at every step, we need to ensure that our family and their needs are secured. People falling under the below categories should consider investing in term insurance-

- Parents: For children, their parents are the ones who bear all the responsibilities and are the sole source of financial support. However, the sudden demise of a parent can put a full stop to their dreams and aspirations. Therefore, parents need to buy a term insurance plan so that they can ensure a happy and worry-free life for their children.

- Newly Married: Along with happiness and excitement, getting married brings a lot of responsibilities under the hood, which mainly revolve around planning a financial future. Term insurance can help you with the same. In case of your demise, a term plan will provide the necessary financial support to your spouse to continue living ahead.

- Tax Payer: Living in a country of taxes, sometimes paying them can hit you hard. Luckily, there is a solution to reduce your tax burden. With term insurance, you can grab tax benefits under section 80D and 10(10D) of the Income Tax Act, 1961.

- Working Professionals: If you have just started your career, then it's the best time to invest in term insurance. Why? Because you have fewer responsibilities and dependents on your shoulders. Moreover, the earlier you start, the less premium you have to pay.

- Self-Employed Person: Being self-employed is not easy. Lack of a fixed income and a list of challenges can be painful. Plus, if you have taken a loan to start your own business, it can become a burden on your family after your death. Therefore, term insurance can look after the financial liabilities and allow your family to live debt-free.

Why Should You Buy Term Insurance Online?

Buying term insurance online saves a lot of time and energy for the customer. Other key advantages are listed below-

Lower Premium

Buying policies online grants lower premium rates as there are no middlemen involved in the whole process. Many other overhead costs like office costs, distribution channels, etc. are saved as well.

Compare & Choose

Online buying helps the potential buyers to evaluate the pros and cons of each plan and select the one that makes them happy.

Easy to purchase

You don't have to travel distances to buy term insurance. Just get a stable net connection and a device to buy from the comfort of your home.

Transparency

One of the advantages of buying term insurance online is transparency. The potential buyer can check out the features and other TnCs of the plans in a detailed manner by simply logging into an insurer's website.

Fast Delivery

As soon as you enter the required details and make the payment, you will get the policy document in your inbox.

Term Life Insurance Plans By The Government Of India

The Central Government of India offers certain term insurance schemes, through which policyholders can safeguard their dependents financially. Let's have a look at them.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

The Pradhan Mantri Jeevan Jyoti Bima Yojana is a life insurance policy that can be renewed on an annual basis by policyholders.

Key Features:

- This policy offers a life cover of Rs. 2 lakhs.

- The premium charged for this plan is Rs. 330 per annum.

- Individuals between 18 years and 50 years can purchase this policy.

- Tax benefits can be availed as per the prevailing tax laws.

Aam Aadmi Bima Yojana

The Aam Aadmi Bima Yojana was formed as a merger of two social security schemes, namely the Aam Aadmi Bima Yojana and the Janashree Bima Yojana, which previously existed.

Key Features:

- To subscribe to this scheme, members need to be between 18 years and 59 years.

- The initial premium that will be charged for this scheme is Rs. 200, out of which 50% of the premium amount will be subsidized from the Social Security Fund.

- This scheme also provides accidental death/disability benefits and a scholarship benefit.

Which Factors Affect The Term Insurance Premium?

Below is a list of a few factors that have a direct impact on the term insurance premium. Let's check them out.

- Age: The basic idea of term insurance is to offer financial coverage to the claimant in return for a premium amount, which is directly linked with the age of the policyholder. That means, the older you opt for a term plan, the higher premium you have to pay. Let's understand this statement with the help of an example.

Mayank (30 years old) is planning to buy a term insurance plan with a coverage of Rs.1 crore (till 65 years of age).

Age

Maturity Age

Policy Term

Annual Premium (Rs.)*

30 years

65 years

35 years

9,363

35 years

70 years

35 years

13,139

40 years

75 years

35 years

19,056

**Last Updated on 11-02-2021

*This premium is provided by ICICI Prudential.

As per the above table, it is safe to say that Mayank should consider buying a term plan at 30 years of age as he would have to shell out less premium. If he buys term insurance at the age of 35/40 years, he will have to pay an extra premium.

- Gender: According to some records and surveys done in India, women have a life expectancy of 70.4 years, while men have 67.8 years. This means, women live longer than men. Fortunately, insurance companies work on risk-based pricing. Therefore, women have to pay a lower premium as compared to men.

- Coverage & Term: The higher the coverage you choose, the higher premiums need to be paid. This applies to a longer policy period as well.

- Self & Family Health History: If the policyholder has a history of health issues such as diabetes, high blood pressure, among others, then the insurance companies charge a higher premium amount. Moreover, the company may charge higher premiums if one has a family history of critical illness.

- Profession: Your work profile is also one of the significant factors that determine your premium amount. For example, if a policyholder is employed in a high-risk work profile (mining), there is a greater risk of injuries/illnesses. So, the insurance company will charge a high premium in return for the policy.

- Lifestyle: The way you live your life affects the term insurance premium. For example, if you are a regular smoker/drinker, you have to pay a higher premium.

How to Choose a Right Term Insurance Plan?

Varun, a 30-year-old MBA professional, is the sole breadwinner of the family. He lives with his parents, wife, and one kid (aged 7 years). His monthly expenses are Rs.50000, including an EMI of a car loan of Rs.12 lakhs.

Knowing his family's financial condition, he decided to look into term insurance. Below are a few points that Varun kept in mind while buying the right term insurance.

- Assessing Family's Needs and Requirements: The first and the foremost step while choosing a term cover is to assess your coverage needs. Keeping this in mind, Varun calculated his monthly expenses and EMI and then looked out for terms plans with a desirable sum assured.

- Policy Tenure: After thorough research, Varun made sure that his policy tenure was not too short because the policy might lapse before his financial obligations are completed.

- Riders: Apart from natural death, risks like accidents and illnesses can also hamper the financial stability of Varun's family. Therefore, he added a few riders to get extra protection.

- Claim Settlement Ratio: An insurance company may have a good brand value, but if its CSR is low, there is no point in taking a policy from its hood. A company with a higher claim settlement ratio means that it takes your claims seriously. Varun made sure to check out his respective insurer's CSR.

- Ease of Buying: Varun chose a term plan, which was available online and he didn't have to visit the branch of the insurance company to carry out the buying process.

How Much Term Insurance Cover Is Sufficient For You?

After you decide to purchase term insurance, the next question that comes to your mind is- how much coverage is sufficient for you? Luckily, the below-listed pointers can assist you with the same. Let's take a look-

- Annual Income: If we listen to the industry experts, the thumb rule for choosing a term cover must be 15-20 times of your annual income. For example, if your annual income is Rs.5 lakhs, your choice of minimum cover should be Rs.75 lakhs-1 crore.

- Lifestyle: Your lifestyle also plays an important role while deciding your term insurance cover. For example, if you work in a high-risk environment or live a non-healthy life, the risk of your health deteriorating is higher. Therefore, you should go for a higher cover.

- Responsibility: If you are the only breadwinner, then your death could cause serious financial crunches in your family. Thus, to provide your family with ample funds, make sure to opt for a high sum assured.

- Liabilities: If there is a loan hovering over your head, your immediate demise can put a lot of heat on your family. Therefore, it's better to buy a term plan with ample coverage for your family's financial safety.

How To Compare & Buy Term Insurance From PolicyX.com?

PolicyX.com has designed a simple process to buy term insurance online. Here are the steps-

01

Scroll-up to the top-right corner of this page and find 'Compare Term Insurance Plans Online'.

02

Enter the required details and click on 'Continue'.

03

Submit your income, city, and click on the 'Proceed' tab.

04

The next page will show various term plans offered by different insurance providers. You can check out the features and benefits of each of them.

05

Buy a suitable plan by clicking the 'Buy' tab.

06

Make the payment and you will receive the soft copy of your policy on your registered email id.

What All Documents Are Required To Buy A Term Insurance Plan?

- Last 3 months salary slips or income tax returns for the last 3 years.

- Form 16 (in the case of salaried professionals) and Form 16 A (for self-employed or freelancers).

- One passport size photo.

- Identity proof such as Aadhar card, Pan card, Driving license, etc.

- Others requested by the company.

How To Get A Successful Claim In Term Insurance?

In case of the demise of the policyholder, the nominee should inform the insurance company and share the required documents with them. Documents will vary in different scenarios and are bifurcated below for your reference.

Case 1: Natural Death

- Policy document in original.

- Claim form issued by the insurance company.

- Application from the claimant.

- Any other documents required by the insurance company.

Case 2: Accidental Death

- Post Morterm report of the accident.

- FIR report of the police.

- Policy document in original.

- Claim form issued by the insurance company.

- Statement of attending doctor or certificate of medical attendance.

- Any other documents required by the insurance company.

Case 3: Death Due to Sickness

- Original discharge summary from the hospital.

- Supporting medical reports.

- Policy document in original.

- Claim form issued by the insurance company.

- Application from the claimant.

- Any other documents required by the insurance company.

Case 4: If Nominee Also Dies Along with Insured

In such cases, the legal heir of the claimant becomes the beneficiary. The legal heir can get the benefits only after attaining the age of 18. But his/her guardian must immediately inform the insurance company. The age criteria may depend completely on the provisions of the insurance companies or IRDA.

Case 5: If the Nominee Dies Before the Policyholder

When a nominee dies before the policyholder, it's the responsibility of the policyholder to nominate other beneficiaries. This can be done either online or by informing the customer care.

Note: Once the insurance provider accepts the claim, it will release the pay-out. If the claim is rejected, the reasons for the same will be communicated to the claimant.

Are Deaths Due To Coronavirus Covered By Term Insurance Plans?

While a few life insurance policies have exclusions for a specific cause of death, coronavirus is covered in all the existing/new life insurance policies. However, it is advisable to pay attention to the guidelines of life insurance and add-on plans, whose benefit is paid if the claim is approved by the insurance company.

Can You Purchase Term Insurance Right Now?

For all the new applications of term insurance during COVID times, insurance companies calculate the premium of the policy based on medical history and the health of the customers. Hence, the pandemic may have an impact on the term insurance premium and the acceptance of the policy as well.

If the buyer's application is in process and (s)he gets diagnosed with COVID-19, then the company might reject or hold the policy. The buyer should make sure that (s)he is sharing all the information with the insurer whether it is related to COVID or not. This will prove to be useful at the time of filing a claim.

How To File A Coronavirus Term Insurance Claim?

Listed below is a convenient process to file a term insurance claim due to COVID-19.

- Inform the respective insurance provider about the insured's death at the earliest.

- Collect the claim form from the official website of the company or the nearest branch.

- Collect all the documents from the hospital (if the death has occurred in the hospital). Don't forget to collect the death certificate from the municipal corporation office.

- Submit the claim form, death certificate, hospital, and KYC documents of the insured & the nominee.

- Submit the bank details.

- Once the nominee fulfills all the requirements, the company will analyze the documents and process the same further.

- If it gets approved, the amount will be transferred to the registered bank account. In case of rejection, the company will inform the same through a message, call, or letter.

Note: The claim process varies from insurer to insurer. You must check with your provider about the same.

Documents Required To File A Claim Based On The Cause Of Death Due To Coronavirus

Medical records including test reports, discharge papers, admission notes, etc

Bank account details

Original death certificate

Claim form and ID proof

Policy document in original

Others requested by the company

What Is Not Covered In Term Insurance?

Just like every other thing in the market, term insurance comes with a (*) sign- exclusions. Let's view it.

Death due to the following reasons are not covered-

- Consumption of drugs/liquor.

- Pre-existing diseases.

- Complication due to pregnancy/childbirth.

- Act of criminal nature.

- Suicide (within 1 year of issuance of the policy).

- War or involved in a hazardous activity.

Term Insurance Companies

- Aegon Term Insurance

- Aviva Term Insurance

- Bajaj Allianz Term Insurance

- Bharti Axa Term Insurance

- Birla Sun Life Term Insurance

- Canara HSBC Term Insurance

- Edelweiss Tokio Term Insurance

- Exide Term Insurance

- HDFC Term Insurance

- ICICI Term Insurance

- IDBI Federal Term Insurance

- Kotak Term Insurance

- LIC Term Insurance

- Max Life Term Insurance

- PNB MetLife Term Plan

- Reliance Nippon Term Insurance

- SBI Term Insurance

- Tata AIA Term Insurance

Term Insurance FAQ's

1. What is the minimum age and income to buy term insurance?

2. What is the difference between term insurance and life insurance?

3. How much tax will I save by buying term insurance?

4. I occasionally smoke with my friends. Do I need to disclose this information while buying term insurance?

5. I have diabetes. Can I get myself insured under term insurance?

6. Whom shall I contact if my claim is rejected?

7. Can I add a rider to my existing term insurance plan?

8. Are your agents qualified enough to handle my queries?

9. Will my premium amount change during the policy tenure?

10. I'm unable to find my policy document. How can I get its duplicate copy?

11. Can an NRI buy term insurance?

12. If I die due to a natural calamity/disaster, will my family/nominee receive the sum assured?

13. If I die outside the Indian territory, will it be taken into consideration?

14. Can I switch my term policy from one provider to another?

15. Why should I choose limited pay rather than a regular pay term plan?

16. Why should I buy Limited Pay vs Regular Pay Term plans

17. Can I change the duration of life cover after the policy is issued to me?

18. Why are premium rates higher for smokers than non-smokers?

19. Do I need to declare myself as a tobacco user if I smoke occasionally?

20. Will I be able to avail of a death benefit in case of natural deaths?

21. Can I increase my sum assured during the policy tenure?

22. I want to port my term insurance policy from one insurer to another. Can I do that?

23. What if my policy has lapsed?

24. What is the free look period and will I get a complete premium back if I cancel my policy?

25. Can I avail of a loan under a term insurance policy?

26. I have lost my policy document. How can I get the duplicate policy?

27. What happens if I discontinue paying the premiums?

28. Is it possible to add a rider to an existing policy?

29. How much time will it take to settle any claim?

30. What if the claim is rejected?